Monday - 7 7:45 AM - 17:15 PM

Monday - 7 7:45 AM - 17:15 PM

Home / What to know about motorcycle insurance?

21/03/2022

1. Failure to bring compulsory motorbike insurance will be fined up to 200,000 VND According to the provisions at point d, clause 2, Article 58 of the Law on Road Traffic 2008 and Decree 03/2021/ND-CP, road users must carry compulsory motorcycle insurance.

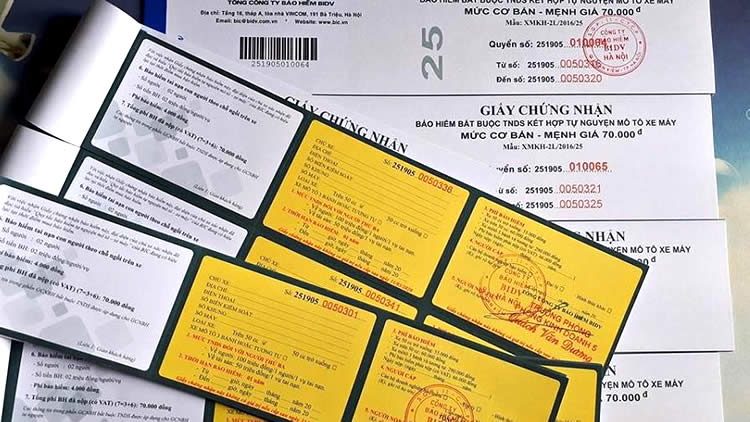

Illustration

If the driver of the vehicle does not have or does not bring a valid certificate of civil liability insurance of the motor vehicle owner (motorcycle insurance), a fine of from 100,000 VND to 200,000 VND (point a, clause 2 of this Article) will be imposed based on Decree 21 100/2019/ND-CP, Clause 11 Article 2 Decree 123/2021/ND-CP).

2. The electronic motorcycle insurance can be used instead of the paper version

- Clause 4, Article 6 of Decree 03/2021/ND-CP stipulates as follows:

“In the case of issuance of an electronic insurance certificate, the insurance enterprise must comply with the provisions of the Law on Electronic Transactions and guiding documents; The e-insurance certificate must fully comply with current regulations and fully reflect the contents specified in Clause 3, Article 6 of Decree 03/2021/ND-CP.”

- Silmutaneously, in Clause 3, Article 18 of Decree No. 03/2021/ND-CP stipulating the obligations of the insurance buyer and the insured, specifically:

“Always carry a valid Certificate of Insurance (hard copy or electronic copy) when participating in traffic, present this document at the request of the Traffic Police and competent authorities. otherwise prescribed by law.”

Thus, road users can use the electronic compulsory motorcycle insurance and present the electronic compulsory motorcycle insurance to the authorities upon request instead of the compulsory motorcycle insurance in written.

3. Where to buy compulsory motorcycle insurance?

According to the provisions of Decree 03/2021/ND-CP, people can buy compulsory motorcycle insurance at insurance enterprises that are allowed to deploy compulsory insurance for civil liability of motor vehicle owners according to regulations. provisions of the law.

Thus, car owners can go to the following locations to directly buy motorbike insurance:

- The nearest insurance company headquarters;

- Insurance distribution agent;

- Bank;

- Gas station,…

Especially, now, car owners can buy motorbike insurance online through e-wallets.

4. Compulsory motorcycle insurance has a maximum term of 3 years

According to the provisions of Point a, Clause 1, Article 9 of Decree 03/2021/ND-CP, compulsory motorcycle insurance has a minimum term of 01 year and a maximum term of 03 years.

In the following cases, the insurance period is less than 1 year:

- Foreign motor vehicles temporarily imported for re-export less than 1 year for participating in traffic in the territory of the Socialist Republic of Vietnam;

- Time limit of motor vehicles is less than 1 year as prescribed by law;

- Motor vehicles subject to temporary registration according to regulations of the Ministry of Public Security.

5. Mandatory motorbike insurance premium

Insurance premium is the sum of money that the motor vehicle owner must pay to the insurance enterprise when buying compulsory insurance for the civil liability of the motor vehicle owner. Motorcycle insurance premiums are specified in Appendix I issued together with Circular 04/2021/TT-BTC, specifically:

- 2-wheel motorcycles:

+ From 50 cc or less: 55,000 VND.

+ Over 50 cc: 60,000 VND.

- 3-wheel motorcycle: 290,000 VND.

- Motorcycles (including electric scooters) and similar motor vehicles:

+ Electric motorbike: 55,000 VND.

+ Other vehicles: 290,000 VND.

6. Compulsory motorcycle insurance liability level

- The level of insurance liability for damage to health and life caused by motor vehicles is VND 150 million per person in an accident.

- Level of liability insurance for property damage:

+ Due to two-wheeled motorcycles; three-wheeled motorcycles; motorcycles (including electric scooters) and other vehicles with similar structure as prescribed by the Law on Road Traffic cause 50 million VND in an accident.

+ Due to cars; tractor; trailers or semi-trailers towed by cars or tractors; Special-use motorbikes according to the provisions of the Road Traffic Law cause 100 million VND in an accident. (Article 4 Circular 04/2021/TT-BTC)

7. 08 cases not being compensated by motorbike insurance enterprises

The insurer does not pay damages in the following cases:

- Intentional act of causing damage by the motor vehicle owner, the driver or the person suffers damages.

- The driver who caused the accident intentionally fled and failed to fulfill the civil responsibility of the motor vehicle owner. In case the driver causing the accident intentionally flees but has fulfilled the civil liability of the motor vehicle owner, the insurance liability is not excluded.

- Người lái xe chưa đủ độ tuổi hoặc quá độ tuổi điều khiển xe cơ giới theo quy định pháp luật về giao thông đường bộ; người lái xe không có Giấy phép lái xe hoặc sử dụng Giấy phép lái xe không hợp lệ (có số phôi ghi ở mặt sau không trùng với số phôi được cấp mới nhất trong hệ thống thông tin quản Lý Giấy phép lái xe) hoặc sử dụng Giấy phép lái xe không do cơ quan có thẩm quyền cấp, Giấy phép lái xe bị tẩy xóa hoặc sử dụng Giấy phép lái xe hết hạn sử dụng tại thời điểm xảy ra tai nạn hoặc sử dụng Giấy phép lái xe không phù hợp đối với xe cơ giới bắt buộc phải có Giấy phép lái xe. Trường hợp người lái xe bị tước quyền sử dụng Giấy phép lái xe có thời hạn hoặc bị thu hồi Giấy phép lái xe thì được coi là không có Giấy phép lái xe. - The driver is under age or over the age to operate a motor vehicle in accordance with the law on road traffic; the driver does not have a Driver's License or uses an invalid Driver's License (whose number of blanks on the back does not match the number of the latest issued blanks in the driver's license management information system) or Using a Driver's License not issued by a competent authority, having a Driver's License erased, or using an expired Driving License at the time of the accident, or using an inappropriate Driving License for For motor vehicles, a driver's license is required. In case a driver is deprived of the right to use a driving license for a definite term or has his driving license revoked, he is considered to have no driving license.

- Damage leads to indirect consequences including: decrease in commercial value, damage associated with the use and exploitation of the damaged property.

- Damage to property caused by driving a vehicle with alcohol in the blood or breath, using drugs and stimulants prohibited by law.

- Damage to property stolen or robbed in an accident.

- Damage to special properties including: gold, silver, precious stones, valuable papers such as money, antiques, rare pictures, corpses, remains.

- War, terrorism, earthquake. (Article 13 Decree 03/2021/ND-CP)